Advanced Techniques in Bank Lending & CREDIT RISK ANALYSIS

By the end of this course you will be able to:

.

.Effectively decide risk rating and pricing of loans.

.Identify early warning signals and initiate proactive measures.

.Understand and utilize new credit risk models for managing counter-party and portfolio risks.

Course Outline:

. Evaluation of financial risk

. Challenges in getting quality financial information from borrowers

. Window dressing of accounts

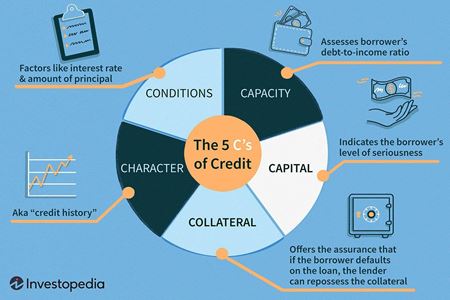

. Non-financial risk analysis

. Understanding and analyzing economic scenario

. Macro level risk factors

. Industry risk analysis

. Borrower-specific risk analysis – operations, marketing, etc.

. Analyzing cash flows

. Projecting cash flows and debt servicing capacity

. Structuring of loans

. Assessing credit requirements for seasonal industries

. Exploiting lending opportunities in services sector

. Follow-up and monitoring of loans

. Risk rating of borrowers

. Pricing of loans

. Customer Profitability Analysis

. Risk Adjusted Return on Capital (RAROC)

. Identification of early warning signals

. Credit risk models – counter party risk and portfolio risk

. Case studies and exercises, besides sharing of international experiences

Target Audience:

. Those working in corporate, commercial or SME lending. Those working in risk management, internal audit and compliance will also find the program useful

10 Days

10 Days

Prerequisites:

.About two years’ work experience in corporate, commercial or SME lending

.Proficiency in English

This course entitles you to attend:

Upon successful completion of this course, participants will obtain:

. “Advanced Credit Course” can be delivered as standalone course after preciously define the target audience, and their training needs, or it can be delivered as “Credit Program”, which includes more than one module.

Bilingual

Bilingual