- الصفحة الرئيسية /

- Trade Finance Products Services Tailored For ANB

الدورات

- النماذج المالية

- شهادة مسئول الالتزام ( المنهج التطبيقي )

- مكافحة غسل الأموال وتمويل الإرهاب المستوي المتقدم

- مكافحة استخدام أدوات التجارة فى غسل الأموال للعاملين فى إدارات الإلتزام و مكافحة غسل الأموال

- مكافحة غسل الأموال وتمويل الإرهاب- مبتدء

- مكافحة غسل الأموال لشركات الصرافة

- تأثير التوصية 16 الصادرة من FATF على الممارسات المصرفية فى مجال تحويلات العملاء

- الإصدار785 لسنة 2016 - ICC

- رسائل السويفت للحوالات – مرحلة أولى

- البرنامج التدريبى الكامل للإعتمادات المستندية

- تعديلات 2018 فى رسائل السويفت المستخدمة فى عمليات تمويل التجارة

- مكافحة استخدام أدوات التجارة فى غسل الأموال للمتخصصين فى عمليات التجارة الدولية

- أساسيات التجارة الدولية

- الالتزام، الحوكمة، ومكافحة غسل الأموال لأعضاء مجلس الإدارة

- مكافحة غسل أموال - مستوى متقدم

- MT103, MT202التعديلات الجديدة في رسائل حوالات العملاء

- بحث حالات الاشتباه في عمليات غسل الأموال

- التحليل المالي لموظفي الحظر و التحقيقات

- تمويل التجارة

- بحث حالات الاشتباه في عمليات غسل الأموال

- تأثير التوصية 16 الصادرة من FATF على الممارسات المصرفية في مجال تحويلات العملاء NCB

- لائحة الأعراف و القواعد الموحدة للأعتمادات المستدية اصدار 600

- تمويل التجارة

- رسائل السويفت المستخدمة في عمليات التجارة الدولية

- الالتزام ومكافحة غسل الأموال

- الالتزام ومكافحة غسل الأموال

- تحليل وتفسير القوائم المالية

- الالتزام ومكافحة غسل الأموال للمديرين (AT)

- Legal aspect of bank lending ANB

- مكافحة الجرائم المالية في مجال تمويل التجارة

- Selling Skills

- التمويل المصرفي وتحليل مخاطر الائتمان

- Trade Finance Products Services Tailored For ANB

- تطبيق المادة 10 من نظام مكافحة غسل الأموال وأتارها على حوالات العملاء

- المحاسبة المالية -2

- المحاسبة المالية - 1

- إعداد وتحليل قائمة التدفقات النقدية

- الجوانب القانونية للإقراض المصرفي

- الحوالات المحلية باستخدام نظام سريع

- المحاسبة المالية المتقدمة

- إدارة مخاطر الائتمان

- تعديلات رسائل السويفت - الرسالة MT103

- ادارة ومعالجة الديون المتعثرة

- اساسيات العمل المصرفي المتوافق مع الشريعة

- أساسيات العمل المصرفي

- تحليل مخاطر الائتمان المتقدم

- تمويل العقود

- تطبيقات المرابحة والمشاركه في تمويل التجارة الخارجية

- صيغ التمويل المتوافقه مع الشريعة

- مكافحة غسل الاموال لشركات التمويل

- مكافحة الجرائم التجارية، دليل ارشادى للأتزام و مكافحة غسل الأموال بإستخدام أدوات التجارة ( اعتمادات مستندية، تحصيلات، ضمانات و حساب مفتوح) مبادئ وولفزبرج للتجارة

- لائحة الاعراف والقواعد الموحدة للاعتمادات المسندية اصدار 600

- Wolfsberg Payment Transparency Standards

- Latest ICC. Opinions in Documentary Credits Publications 799, 802, 807

- ادارة علاقة العملاء

- ادارة التغيير والنجاح والوظيفي

- التميزبخدمة العملاء

- Operational Risk Managenent

- المالية لغير الماليين

- Swift Messages 100

- SWIFT MESSAGES 700

- مكافحة غسل الأموال لأعضاء مجلس الإدارة

- تقييم مخاطر الأعمال والائتمان

- Enterprise Risk Management (ERM).

- Corporate Governance Best Practice

- Operational Risk Management

- الاحتيال المالي المصرفي

- معايير المحاسبة والابلاغ المالي الدولية واحدث التعديلات

- SWIFT messages used in trade finance - NCB

- Document Examination and Doc. Collection (samba)

- الالتزام والحوكمة المؤسساتية

- مكافحة غسل الاموال وتمويل الارهاب لشركات المحاماة

- تحديثات مارس 2019 - مبادئ وولفسبرج لتمويل التجارة

- latest update of the wolfsberg, ICC and BAFT trade finance principles

- أساسيات المدفوعات

- AML & CFT Introductory

- Financial Derivatives

- Financial Accounting - 1 ( En)

- الشهادة التاسيسية لمصرفية الافراد

- الالتزام ومكافحة الجرائم المالية

- COSOدورة تقييم أنظمة الرقابة الداخلية وفق مفهوم

- مكافحة غسل الاموال باستخدام خدمات وتمويل التجارة لاخصائي الالتزام والمكافحة

- الحوكمة المؤسساتية لشركات الصرافة

- ATBML (ANB)

- REC.16 & Article10 of Saudi Arabia AML Law - (ANB)

- SWIFT RMA Due diligince (ANB)

- Wolfsberg Correspondents Relationship - (ANB)

- مكافحة غسل الأموال وتمويل الارهاب

- الدورة التحضيرية لشهادة المستشار الائتماني

- ICC. Guidance Notes for Documentary Credit Formats & 807 latest opinions

- SWIFT messages used in the reconciliation - NCB

- Compliance and Operating Risk

- Analyzing Bank Financial Statements And Rating Of Banks

- Risk Based Internal Auditing Virtul Online Training

- المهارات البيعية المتقدمة

- المهارات البيعية الفعالة

- SWIFT messages used in reconciliation

- مكافحة غسل الأموال وتمويل الإرهاب لأعضاء مجلس الادارة

- Accounting / Finance For Future Leaders

- Documents examination according to ISBP 745

- رسائل السويفت الجديدة في خطابات الضمان

- إكتتاب التأمين الطبي

- التأمين البحري

- التأمين الهندسي

- تأمين المركبات

- مكافحة غسل الأموال وتمويل الإرهاب ومكافحة الاحتيال

- إئتمان الشركات المتقدم - مؤشرات التعسر المالي

- ورشة عمل لإدارة المراجعة الداخلية نطاق عمل المراجعة لإدارة مكافحة غسل الأموال وإدارة الالتزام بالبنك

- Preparing for a crisis /disaster

- Crisis Management Strategy

- مهارات الكتابة واعداد التقارير

- مهارت القراءة السريعة

- Documentary collection URC522

- استمرارية الاعمال

- شرح مصطلح "بدون تأخير" الوارد في لائحة الأعراف والقواعد الموحدة للاعتمادات المستندية

- جودة الدخل العقاري وأداء الاستثمار

- الذكاء العاطفي

- Fundamentals of Analyzing Real Estate Investments

- شهادة مسئول الالتزام المعتمد بالأكاديمية المالية

- دورة مكافحة غسل الأموال وتمويل الإرهاب ( لأعضاء مجلس الإدارة واللجان التابعة )

- Credit Administration Functions

- Advanced Corporate Credit Analysis

- Facility Structure and Lending Techniques

- Credit Applications and Report Writing

- Principles of Corporate Finance

- Lending Rationales

- Working Capital and the Asset Conversion Cycle

- Tools of Credit Analysis

- Corporate Finance and Valuation

- الثقافة المالية للمصرفيين

- From MT to MX, The new ISO 20022 Payment Messages specialized for remittance dept

- From MT to MX, The new ISO 20022 Payment Messages specialized for trade finance dept

- Compliance requirements for the new iso 20022 payment messages

- مدخل الى إدارة الموارد البشرية

- مدخل الى التسويق

- Real estate commercial director suit

- الدورة الإعدادية لأخصائي إدارة المخاطر المعتمد

- From MT to MX The new ISO 20022 Payment Messages Reconciliation

- فن إعداد الموازنات واتخاذ القرارات المالية

- الحسابات غير المتحركة

- إصدار821 الصادر من غرفة التجارة الدولية باريس

- الاكتتاب الطبي

- مقدمة بالأمن السيبراني

- Detecting and combating fraud in finance companies.(English)

- دورة الالتزام ومكافحة غسل الأموال وتمويل الارهاب

- ورشة عمل نطاق التقييم الذاتي لإدارة مكافحة غسل الأموال وإدارة الالتزام بشركات التمويل

- إدارة علاقات العملاء بأداء فعال

- قواعد فتح وتشغيل الحسابات

- لالتزام ومكافحة غسل الأموال وتمويل الإرهاب لشركات التمويل

- Documents examination according to ISBP 821

- مهارات التفاوض والتاكيد

- رسائل الايزو المتقدمة

- تطبيق توصية مجموعة العمل المالي رقم 16 ومتطلبات معايير الشفافية في المدفوعات المحدثة في أكتوبر 2023 لتحويلات العملاء

- الاكتتاب الطبي

- دور ومسئوليات إدارات الرقابة الداخلية في كشف ومكافحة الاحتيال المالي في شركات التمويل

- مكافحة شاملة للاحتيال

- معرفة عامة برسائل السويفت

- رسائل الايزو 20022 المستخدمة في المدفوعات وأدوات تمويل التجارة

- Advanced Cash Flow Analysis & Structuring Banking Facilities

- Writing and Presenting Effective Credit Application

- كشف ومكافحة الاحتيال المصرفي

- كشف ومكافحة الاحتيال الرقمي في البنوك

- مكافحة الجرائم المالية باستخدام أدوات التجارة

- أسواق رأس المال والمشتقات المالية

- الطرح العام للمهنيين

- البرنامج التحضيري للاختبار المهني للشهادة الدولية في إدارة الثروات والاستثمار- (CME-4)

- رسائل المدفوعات ايزو 20022 لإدارة الخزينة- الجزء الثاني

- تحديث رسائل المدفوعات ايزو 20022 لإدارة التجارة

- قواعد فتح وتشغيل الحسابات ومبدا اعرف عميلك والعناية الواجبة للعملاء

- رسائل المدفوعات ايزو 20022 استبدال رسائل MT 202 & MT 103

- من الحوكمة إلى الميدان "الإدارة الرشيدة للحوكمة والامتثال والمخاطر في بيئة المدفوعات الحديثة للسادة أعضاء مجلس الإدارة واللجان التابعة في شركات المدفوعات"

- قبول العضويات والرقابة عليها

- برنامج تحضيري لامتحان أساسيات التأمين المهني

- مبادئ وولفسبيرج، غرفة التجارة الدولية و بافت – 2017

- مقدمة في الائتمان المصرفي

- Murabha Finance '' Applications Feilds "

- SWIFT Messages Used in Funds Transfer (Stage 2)

- Swift messages for funds transfer advanced Level

- كشف التزوير والتزييف للوثائق والمستندات للعاملين في الغرفة التجارية والصناعية

- شروط التجارة الدولية 2020

- التدقيق الداخلي المستند للمخاطر تطبيقات عملية في شركات الصرافة والتحويل المالي

- أساسيات اعداد المذكرة الائتمانية

- Swift Universal Payment Confirmation

- الخطة البيعية لفرع بنك

- مهارات الاتصال الفعال

- مهارات التفاوض المتقدم

- أساسيات الالتزام

- Wolfsberg, ICC, BAFT Trade Finance / AML-Compliance Requirements

- المتطلبات الرقابية الخاصة بالإلتزام و مكافحة غسل الأموال في مجال تمويل التجارة(مبادئ الوولفزبرج لتمويل التجارة)

- International trade in practice

- Advanced Corporate Credit

- Documentary credits in practice

- مكافحة غسل الأموال وتمويل الإرهاب للجمعيات الخيرية

- SME's Financial Statement Analysis

- SME's Credit Analysis

- Product Development for SME Banking

- نظام المنافسات الحكومية

- التميز في خدمة العملاء

- Risk Based Auditing

- Financial Analysis Using Excel

- المعايير الدولية لممارسات خطابات الضمان عند الطلب

- العميل المبتهج

- مهارات التحصيل الفعال للبطاقات الائتمانية ما قبل الشطب " Pre-write off "

- مهارات التحصيل الفعال للتمويل الشخصي والعقاري

- القواعد الموحدة لخطابات الضمان عند الطلب الصادرة عن غرفة التجارة الدولية نشرة رقم 758

- البرنامج التحضيري لاختبار الالتزام المستوى التأسيسي

- اختبار الشهادة العامة للتعامل في الأوراق المالية: التشريعات – الجزء الأول (CME1)

- اختبار شهادة المطابقة والالتزام ومكافحة غسل الأموال وتمويل الإرهاب (CME2)

- المهارات الاحترافية للمستفيدين من خطابات الضمان المصرفية

- المقارنة بين خطابات الضمان عند الطلب واعتمادات الجهوز وقواعدهما نشرة رقم 758 ونشرة رقم 590

- خطابات الضمان عند الطلب واعتمادات الجهوز

- المهارات الاحترافية لمركز التصال

- مباديء البطاقات الائتمانية والتمويل الشخصي والعقاري

- التميز والجودة في خدمة العملاء

- الشهادة المهنية للالتزام في قطاع شركات التمويل

- Bank Capital Adequacy Under Basel III

- رسائل السويفت المستخدمة في حوالات العملاء (مستوى أساسي ومتوسط)

- Swift trade finance messages

- Centralized cash management for mega corporate using SWIFT MT101

- مكافحة غسل الأموال وتمويل الإرهاب لأعضاء الإدارة التنفيذية

- مكافحة غسل الأموال لشركات التمويل لأعضاء مجلس الإدارة

- ورشة عمل "هل إدارة الالتزام ومؤسستك المالية جاهزة عند زيارة الجهة الرقابية"

- Building up financial culture for RM

- دورة الالتزام لأعضاء مجلس الإدارة/الإدارة التنفيذية

- اساسيات التحليل الفني - المستوى الأول

- اساسيات التحليل الفني - المستوى الثاني

- مؤشرات التحليل الفني - المستوى الثاني

- مؤشرات التحليل الفني - المستوى الأول

- الشموع اليابانية - مستوى متقدم

- رسومات بوينت آند فيجر البيانية

- موجات إليوت

- تحليل الدورات الزمنية

- تحليل علاقات الأسواق المالية

- تقنيات بيع البطاقات الائتمانية

- مهارات وتقنيات بيع القروض العقارية

- تقنيات بيع التمويل الشخصي والعقاري

- الإرشادات المجمعة الخاصة باستخدام البنوك لشرط اخلاء المسؤولية عن الدفع حال وجود كيان من الكيانات الموجودة في الاعتماد او الضمان او المستندات ذات الصلة على قائمة من قوائم الحظر التي يخضع لها البن

- ندوة لشرح الرسالة 760 الجديدة وظائفها الخمسة في اصدار و تبليغ الضمانات

- رسائل أيزو 20022 - رسائل المدفوعات

- البرنامج التحضيري للاختبار المهني للصرافة والتحويل النسخة الثانية

- البرنامج التحضيري لاختبار إفصاح

- Client Engagement

- مشاركة العملاء

- مكافحة التستر التجاري للبنوك والمؤسسات المالية (مستوى أول)

- كشف ومكافحة الاحتيال في شركات التمويل

- الالتزام ومكافحة غسل الأموال لأعضاء مجلس الادارة

- كشف ومكافحة الاحتيال في شركات التمويل لأعضاء مجلس الادارة

- مقدمة في قطاع العقارات وتقييمها

- International trade training program part 1

- رسائل أيزو 20022 - لتمويل التجارة

- كشف التزوير والتزييف للوثائق والمستندات للعاملين في الغرفة التجارية والصناعية

- القيادة بثقة

- مكافحة الاحتيال في مجال التأمين

- خطابات الضمان وكشف الحساب

- الدورة التحضيرية لاختبار فني المحاسبة

- المالية لغير الماليين - للمدراء

- الالتزام، مكافحة غسل الأموال، الاحتيال المالي

- الالتزام، مكافحة غسل الأموال، الاحتيال المالي

- رسائل المدفوعات ايزو 20022 لإدارة الخزينة- الجزء الأول

- .

- تمويل المنشات والمشروعات الصغيرة

- الالتزام ومخاطر التشغيل لشركات الصرافة

- مكافحة غسل الأموال وتمويل الإرهاب المستوي الاول

- Advanced Techniques in Bank Lending & CREDIT RISK ANALYSIS

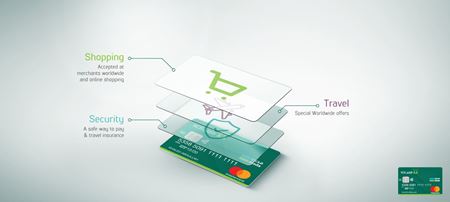

Trade Finance Products Services Tailored For ANB

This This three days’ training course is designed to introduce the trade finance products and services that ANB presents to its corporate customers in the field of international trade.

بنهاية هذه الدورة سوف تكون قادرا على:

.

.

.

.

مخطط الدورة

.

.

.

.

الجمهور المستهدف:

.

.

.

.

.

ثنائي اللغة

ثنائي اللغة